For decades, private capital raising has depended on a closed network: pitch decks sent through email lists, one-on-one coffee meetings, and endless follow-up calls.

For many fund managers, this still sounds familiar.

But investor behavior has changed.

Accredited investors are no longer passively waiting for deals to land in their inboxes; they’re actively browsing curated marketplaces to find, evaluate, and allocate capital to opportunities that fit their goals.

This shift is already reshaping how capital flows into private funds, and in 2025, marketplaces will become the #1 channel for fund managers to connect with investors: efficiently, compliantly, and at scale.

In this blog, we’ll break down:

- How investor sourcing has evolved from personal networks to public platforms

- Why investors prefer curated marketplaces

- How Avestor’s Investor Marketplace gives fund managers instant visibility without heavy marketing spend

- Practical steps to get listed and optimize your offering

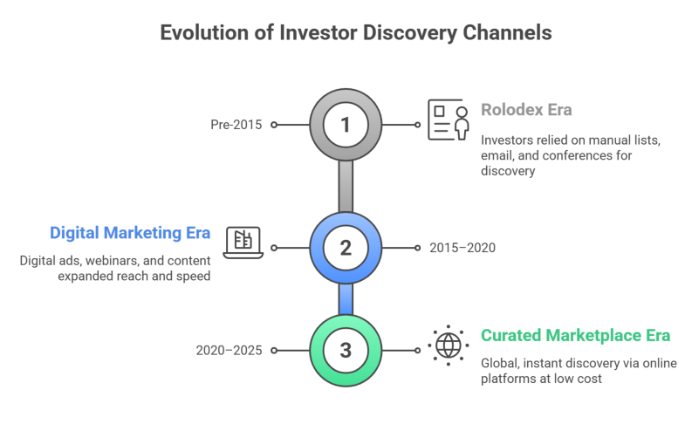

1. Investor Behavior Has Changed: From Rolodex to Marketplace

Raising capital used to be linear: build a list, host a webinar, send a deck, schedule calls, and hope that a fraction of your list is converted. That model relied entirely on who you knew.

But over the past five years, private investors have begun behaving more like institutional allocators:

- They research proactively: Exploring different strategies, geographies, and managers before engaging.

- They compare offerings: Side by side, rather than committing to the first deck they see.

- They expect transparent data: Not just marketing claims.

Technology has accelerated this shift. Just as investors once turned to public stock exchanges for liquidity and price discovery, they’re now turning to private investment marketplaces for deal discovery, due diligence, and diversification.

2. Why Smart Investors Now Prefer Curated Marketplaces

Modern LPs are navigating a crowded private capital landscape. Every week, they receive multiple pitch decks, emails, and webinar invites. It’s overwhelming, and often opaque.

Direct Investor marketplaces solve this. They give investors a structured, transparent environment to discover, compare, and evaluate opportunities efficiently.

Here’s why they’re becoming the default discovery channel:

- Transparency: Investors can clearly see deal terms, track records, fee structures, and tax benefits without chasing managers for data.

- Efficiency: Instead of filtering through dozens of emails, they can browse opportunities in one portal.

- Trust: Marketplaces vet fund managers and offerings, setting a quality baseline and filtering out low-quality deals.

- Optionality: Investors can diversify across multiple asset classes: multifamily, credit, hospitality, self-storage, and even niche verticals, all in one place.

According to recent FINRA and alternative investment reports, more than 50% of accredited investors now prefer online marketplaces as their primary discovery tool for private opportunities.

This is a behavioral shift, not a marketing tactic. Investors are choosing to go where information is centralized, structured, and transparent.

3. What This Means for Fund Managers: Visibility Without Marketing Spend

For fund managers, the implication is simple: if you’re not visible on a marketplace, you’re invisible to a growing pool of investors.

Traditional capital-raising channels come with real costs:

- Hiring agencies for digital marketing

- Paying for 506(c) ad campaigns

- Hosting investor dinners and conferences

- Building in-house marketing funnels

All of this takes months and tens of thousands of dollars.

By contrast, a well-crafted listing on a curated investor marketplace puts your fund in front of accredited investors who are already actively searching for deals. You’re not “pushing”, you’re being discovered.

The Avestor Investor Marketplace takes this one step further:

- Once you launch your fund on Avestor, your offering can be showcased alongside other active offerings.

- Investors can explore your strategy, compare terms, and request a direct connection, all in one place.

- You gain inbound investor leads without the overhead of building a marketing engine from scratch.

4. How to Get Marketplace-Ready with Avestor

Marketplaces are powerful, but they work best when the foundation is solid. You can’t simply upload a deal and expect investor traction.

At Avestor, fund managers first launch their fund on our platform, then our team partners with them to optimize and structure their offerings for the Marketplace.

Here’s how the process works, and how to set yourself up for success:

1. Launch Your Fund on Avestor

The first step is setting up your Customizable Fund® with Avestor. This gives you the legal, operational, and compliance infrastructure needed to raise capital across multiple deals under one umbrella. Without this, your offerings cannot be showcased on the Marketplace.

2. Collaborate with Avestor’s Team to Optimize Your Offerings

Once your fund is launched, our team works closely with you to review your deals through the lens of a direct investor. We evaluate clarity, structure, disclosures, and investor readiness to ensure your offerings meet the Marketplace’s quality standards.

3. Optimize Your Presentation for Investor Discovery

After vetting, we help you craft a compelling Marketplace presence:

- Clear, investor-friendly deal terms

- Clean visuals and branding

- A structured, scannable format that highlights your strategy, track record, asset classes, and minimums

4. Maintain Accuracy and Responsiveness

Keeping your fund and deal information up to date is essential. Marketplace investors expect transparency; outdated docs or slow responses can quickly erode trust.

By going through this process, you’re not just listing a deal; you’re positioning your fund to be discovered by accredited investors in a curated, trust-based environment.

👉 Book a Call to Launch Your Fund & Get Marketplace-Ready

Conclusion

The way private investors discover opportunities has fundamentally changed. Rolodexes and email blasts are giving way to structured, transparent marketplaces where investors browse, compare, and commit capital on their terms.

For fund managers, this is both a challenge and an opportunity. Those who stay invisible will fall behind, but those who position their funds on marketplaces will gain a sustainable, scalable capital-raising advantage.

The future of capital raising isn’t just about who you know. It’s about being discoverable where investors are searching.

👉 Ready to make your fund visible to accredited investors? Explore Avestor’s Investor Marketplace today.