The Real Cost of Raising Capital Nobody Talks About

If you’ve raised capital before, you know it’s not the deals that wear you down; it’s the legal and administrative chaos behind them.

Every SPV means another PPM, another audit, another onboarding cycle. You spend weeks redoing paperwork instead of building investor relationships.

At Avestor, we work with hundreds of fund managers who’ve faced this same challenge.

And we’ve seen a pattern: it’s not lack of capital or investor demand that stalls growth, it’s the weight of outdated fund structures.

The Hidden Cost of Legal Overhead

Legal overhead doesn’t just cost money; it kills momentum.

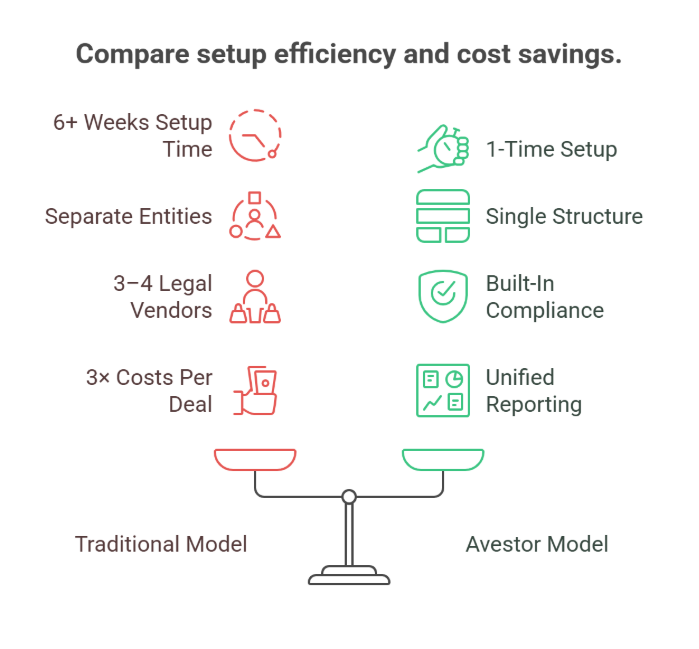

Here’s what the traditional model looks like behind the scenes:

- Entity formation & legal drafting: 3–6 weeks per deal

- Repeat PPMs & subscription docs: every single raise

- Separate audits and tax filings: multiplied across deals

- Manual onboarding: time-consuming, error-prone, and inconsistent

By the time capital is finally ready to deploy, you’ve lost valuable time and investor enthusiasm.

Across our network, we’ve seen emerging managers spend 20–30% of their total capital raised just covering repetitive legal and admin costs. That’s money that could have gone into your next deal, your tech stack, or investor acquisition.

Why This Problem Exists?

The truth is simple: traditional fund structures weren’t built for today’s private markets.

They were designed for static portfolios, single strategies, and investors who were willing to commit blindly for 10 years.

But that’s not how investors behave anymore.

Modern LPs expect:

- Transparency across all active deals

- The ability to choose where their capital goes

- Streamlined reporting, ideally a single K-1

- Real-time communication and performance visibility

Meanwhile, fund managers want the flexibility to raise across multiple asset classes and timelines without redoing legal work every 90 days.

That’s where the friction comes in.

Old structures weren’t designed for speed, flexibility, or scalability.

How Top Fund Managers Are Solving It in 2025

Over the last year, we’ve tracked a major shift among high-performing fund managers. The ones scaling efficiently aren’t raising faster; they’re raising smarter.

Here’s the framework they’re following:

1. Consolidate Your Structure

Instead of forming a new LLC or SPV for every deal, managers now operate under a single umbrella fund that can hold multiple offerings.

This reduces entity duplication, streamlines compliance, and eliminates redundant filings.

2. Standardize Your Documentation

One PPM. One subscription flow. One audit.

By standardizing legal documentation, fund managers are cutting their recurring legal costs by 50–70% while onboarding investors in days, not weeks.

3. Automate Fund Operations

Spreadsheets and manual investor tracking don’t scale.

Fund managers are adopting tech-driven fund management platforms to automate onboarding, reporting, compliance, and investor communication, all from one dashboard.

These three steps form the foundation of our approach at Avestor.

How Avestor Eliminates Legal Overhead

When we built the Customizable Fund®, we asked one question:

How can fund managers raise capital across multiple deals without re-creating the legal, operational, or compliance wheel every time?

Here’s how we answered it:

→ One Legal Framework, Unlimited Deals

Launch your fund once and raise for multiple deals, strategies, and asset classes under one legal structure.

No new entities. No redundant filings.

→ Single Investor Onboarding

Investors onboard once and can self-select which deals to participate in.

This structure gives them flexibility while giving you speed, cutting onboarding time from weeks to hours.

→ Consolidated Reporting

One audit, one tax filing, one K-1 per investor, regardless of how many deals they join.

You save money, and your investors get a cleaner, more transparent experience.

→ Built-In Compliance and Tech

From KYC/AML checks to investor tracking, our back office handles the heavy lifting.

Your fund stays compliant, automated, and investor-ready, all in one platform.

The result:

Fund managers who once juggled multiple SPVs now operate everything under one Customizable Fund®, saving 60–70% in legal and admin costs while deploying capital faster and earning greater investor trust.

A Real Example: From Paperwork Chaos to Scalable Growth

When Scalpel Ventures, a healthcare-focused VC fund, joined Avestor, they were facing the same bottlenecks we see across the industry: repeated entity formation, rising legal fees per deal, fragmented investor onboarding, and limited scalability.

They switched to our Customizable Fund® model and transformed their operations:

- 50%+ cost reduction in recurring legal and administrative expenses

- 10-year fund life + 2-year extension, enabling patient, high-conviction investments

- Faster capital deployment their investment in Artelon produced a 5× return in just 11 months

- One consolidated fund structure, eliminating duplication and improving investor transparency

Investors now enjoy deal-by-deal flexibility within a single fund, complete with unified reporting and consistent updates.

Instead of being slowed by compliance cycles, Scalpel’s team now spends more time sourcing healthcare innovations like Oxford Performance Materials and Artelon, and less time buried in paperwork.

That’s the power of structural leverage.

Read the full Scalpel Ventures case study here.

Quick Audit: Is Your Fund Stuck in the Old Model?

Ask yourself:

- Are you creating new entities for every deal?

- Paying separate legal fees for each raise?

- Sending multiple K-1s at tax time?

- Tracking investors manually?

- Spending more time managing docs than raising capital?

If you said “yes” to even two of these, your structure is holding you back, not your capital or investors.

The Future of Fund Management Is Scalable

At Avestor, we believe flexibility and structure can and should coexist.

That’s why over 450+ fund managers now use our Customizable Fund® to raise smarter:

launch once, raise across multiple deals, and manage all operations inside one compliant, tech-enabled system.

Legal overhead shouldn’t define your growth ceiling.

With the right foundation, you can scale your capital raises, expand into new asset classes, and deliver a seamless investor experience, all without rebuilding your structure every time.

👉 Book a Strategy Call to see how much time and cost your fund could save by switching to a smarter model.